Amidst rising demand for rare earth minerals to supply magnets for manufacturers of motors for electric vehicles and for wind turbines, Japan has committed another AUDS$200 million to Australian producer Lynas Rare Earths for a favored supply chain. The latest tranche, worth about US$135 million, brings total commitment up to about US$400 million.

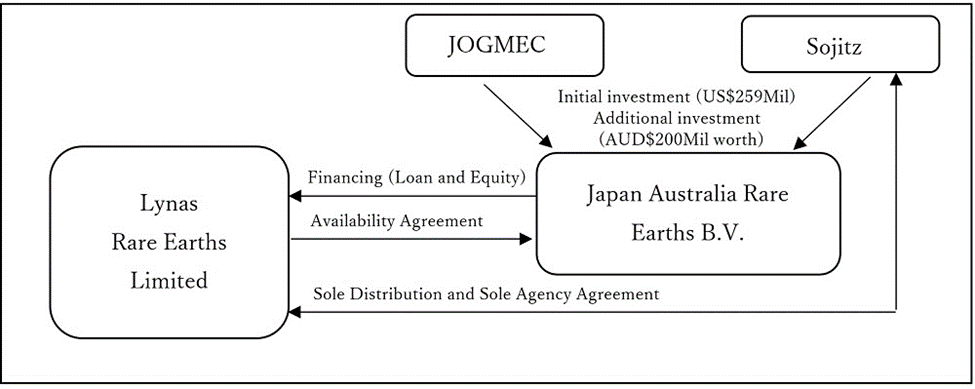

The new deal, signed March 7 in Tokyo, supports Lynas’ growth plan to increase its production, providing a major feedstock for magnets not emanating from mines and processors in China. Providing the funds are Japan Australia Rare Earths (JARE), a special purpose company established by Japan Organization for Metals & Energy Security and Sojitz Corporation.

Lynas and JARE are parties already to a long-term senior loan facility valued at about US$259 million. The new deal calls for priority rights on Lynas’ growth capacity until 2038 in the event of competing demands with other markets: where Lynas’ annual production is less than 9,600 tonnes/annum NdPr, priority supply up to 7,200 tonnes/annum NdPr, to the extent that Lynas will not have any opportunity loss. Once Lynas’ annual production exceeds 9,600 tonnes/annum NdPr and the forecast annual demand for NdPr from the Japanese market exceeds 7,200 tonnes/annum, Lynas and JARE will negotiate in good faith to agree the terms of the availability for the Japanese market. Priority of supply of up to 65% of the DyTb produced from Lynas’ Mt Weld feedstock, subject to any agreement with the U.S. Government and to the extent that no opportunity loss will be suffered by Lynas. Also, Lynas will consider in good faith priority supply to the Japanese market of the remaining 35% of HREs from Mt Weld feedstock, subject to any agreement with the U.S. Government and to the extent there is no opportunity loss to Lynas.

“Lynas has a huge appetite for growth and a large capital investment plan,” commented Lynas CEO Amanda Lacaze. “This $200 million capital investment from the Japanese Government, through JARE, will boost our balance sheet and assist in assuring the delivery of our major growth projects. Today, Lynas is the market leading supplier of NdPr to the Japanese rare earths industry and these new agreements demonstrate the deep commitment of JARE to the ongoing growth and success of our company.”

Rare earths, divided into light and heavy rare earths, are used in various industries including the production of magnets for motors for electric vehicles and wind turbines. Light rare earths are used as the main ingredient to produce magnets for motors. Both types are covered in the agreement as part of the Lynas growth plan is to start the production of heavy rare earths, namely dysprosium and terbium, used to enhance the heat resistance of magnets. In 2011, Sojitz became the sole distributor of Lynas rare earth products in Japan and provides them to Japanese customers.